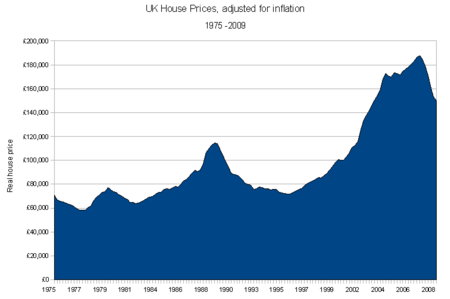

Look at this, imagine yourself a bank or building society lending money to someone who wants to buy, and you're going to want a very substantial deposit. The relevance for Sydenham is that there will be significant numbers of newish property owners who are stuck here, perhaps with the tastes Dot and the Wolf like to make fun of, but not necessarily the money to pay for them. Somehow I think this will impact Sydenham Road over the next few years, though I'm not sure how.

Another part of the property story is the amount of money going into housing benefit, which this pdf shows is where 20% of the money Lewisham handles goes

http://www.lewisham.gov.uk/NR/rdonlyres ... ingMap.pdf

Any government would have to tackle this, and in the short run it's the poorest who will suffer most. But only in the short run; longer term it's buy-to-let landlords and other renters. Some housing associations will probably go bust.

There's a relationship with the mess bankers got themselves into recently, but it's more the legacy of a general obsession with property. Something similar happened in Japan about twenty years ago, and their economy has been fairly stagnant ever since.

Of course, we do have the London Overground effect, so it's not all doom and gloom!